Temporary Contracts

Corporate America is ruled increasingly by the concept of the temporary contract. This is evident in the planned obsolescence of goods, in the diversification of holdings and the dismantling of the spoils from mergers and acquisitions, and in the treatment of employees and buildings as disposable assets. Such practices, often referred to as “flexible accumulation,” now dominate what we call the post-industrial economy. In conjunction with post-industrial technologies—computers and telecommunications—the post-industrial economy has produced a series of distinct post-industrial landscapes characterized by short-term profit and minimal commitment. Indeed, mobile capital has rendered the landscape itself a consumable commodity, one that does not benefit from the kind of enduring relationships that once characterized the national sentiment toward the public realm and its cultural artifacts. While I focus here on post -industrialism in the United States, its inherently global nature is producing similar patterns worldwide.

On the Economy of the Post-Industrial Landscape

The temporary contract has become ubiquitous. In the U.S. the divorce rate is over 60%. One out of five households moves every year. Countless large corporations have sold or vacated their signature headquarters skyscrapers. Malls built in the 1970s are in greater disrepair than many commercial buildings built fifty or 100 years earlier. Leasing, whether of automobiles or real estate, has gained significant market share from owning. The largest single employer in the country is Manpower Inc., a temporary employment agency. The percentage of workers belonging to unions is lower now than in the 1930s, before membership was legalized. Since 1980, nearly three-quarters of all households have been affected by downsizing and layoffs.1 And, while much attention is paid to the 8.5 million new jobs created during the Clinton administration, the cynical response is often, “Yeah, and I hold two of them.”2 One-third of all U.S. employment and one-half of United Kingdom employment is non full-time, and the percentages continue to rise, as does the use of subcontracting as a means of avoiding long-term commitments and the paying of benefits.3 Little wonder that so many children have been diagnosed with Attention Deficit Disorder; their environments are increasingly structured by short-term transactions. The social contracts that supported their grandparents have been ruptured. Marriage vows, the homestead, corporate stability, and job security—all have suffered in the ever-evolving, non-stop world of GATT and NAFTA, of cyberspace, freeways, twenty-four-hour convenience marts and other manifestations of post-industrialism.

Post-industrialism can be defined as the convergence of the “Information Age” and the “Service Economy.” Beginning in the 1970s, increasing competition from the recovered economies of Japan and Germany, as well as market saturation and stagflation, led American corporations to shift from strategies of high-volume mass production (Fordism) to strategies of high-quality, consumer-responsive, flexible production (post-Fordism).4 Speed of innovation and changeable product lines have become key strategies for inducing demand, but require retoolable and increasingly computerized equipment and coordination.

This has occurred simultaneously with the development and mass production of computers and telecommunication networks. The availability of digital technologies and the need to better coordinate supply and demand (after the overproduction and recessions of the ’70s) has led to new corporate reliance on information about markets and inventories. New jobs were created in information services such as market research, advertising, and financial services, while telecommunications networks allowed corporations to shift manufacturing jobs to cheaper labor pools overseas or in suburbia, or to replace them through automation. While manufacturing is still an important function of the post-industrial economy, it has lost its dominant position to the production of images and information. Indeed, the hardware and software required for information management epitomizes the temporariness of post-industrialism. Even yearly upgrades do not keep pace with the speed of obsolescence.

A new set of values has accompanied this expansion of instantaneous communication, electronic media, and disposable products. Speed, mobility, and malleability are not only the mantras of corporate survival (witness the reverence for “downsizing” and “re-engineering”), they have emerged as central attributes of cultural production. David Harvey’s seminal book, The Condition of Postmodernity,5 argues that the transition from the rigidities of Fordism to more flexible modes of capital accumulation, combined with what Harvey calls the experience of “time-space compression” (courtesy of telecommunications, mass media, jet travel, etc.) has led to the rise of a postmodern aesthetic of the fictional, the spectacular, the ephemeral, and the hybrid. Harvey equates the postmodernist aesthetic of speed and mobility with the post-industrial economy. Beyond the stylistic expression of instantaneity, I am interested in examining how these economic conditions and practices have led to an ephemeral and compressed occupation of the low-commitment, leased, and amortized landscape.

Four interrelated phenomena characterize the post-industrial economy, each contributing to the growth in temporary contracts: reliance on telecommunications and information processing; more jobs in services than in manufacturing; globally integrated markets for both production and consumption; and the mobility of capital. All of these have combined to decentralize development. While the industrial economy’s basis in assembly-line mass production promoted centralization and city building, the post-industrial economy’s ability to substitute electronic access for physical access (along with its dependence upon automobiles and highways) has encouraged traditionally urban functions to migrate from the core to the periphery.

The interaction of post-industrial globalization and decentralization has transformed landscapes in three principal arenas: “export processing zones” or other more informal global production sites, downtown financial centers, and exurban “edge cities.”

As reflections of mobile capital, the export processing zones of East Asia, the maquiladoras in Mexico, and the Toyota and Honda plants in the Midwest, are all distinctly post-industrial landscapes where production has moved not simply out of central cities, but offshore. Designed to access international markets as well as cheap, non-unionized labor, more efficient or automated equipment, cheap rents, and cheap shipping, these sites reflect post-industrial corporations’ locational flexibility. As opposed to the Fordist need to consolidate labor, resources, and markets, today’s post-Fordist companies tend to manufacture products in smaller batches, often using parts produced all over the globe; the finished product is then sold to various global markets. This global redistribution of industrial production would seem to equalize development opportunities. However, while Henry Ford recognized that gains in productivity required corresponding gains in consumption, and thus set a pattern of paying relatively high union wages, today’s multinational corporations view the market more competitively. Rather than raising wages in offshore production sites so as to boost local consumption, they tend to produce goods in one part of the world for consumption in another, thus intensifying the unevenness of development. Multinational corporations operating in export processing zones often threaten to leave rather than meet demands to raise wages and deal with unions. They are able to do so because they have distributed production very widely. Their flexibility is further enhanced by reliance on just-in-time deliveries, outsourcing, and subcontracting.

Services are even more mobile than production. New York Life Insurance Company’s processing operations are in Ireland. A developer in the U.K. proposed closed-circuit-TV monitoring of shopping malls and office complexes by low-cost laborers in Africa.6 Exemplifying the contingency of corporate commitment to place, Timex Watches and Seabox, Inc. collaborated in 1992 on a design for a mobile assembly plant built of steel shipping containers gasketed together and bolted to sonotube footings. With minimal disruption to production, the containers could be disassembled, transported overland or overseas, and redeployed. Of course, because capital is mobile but communities are not, the disruption to communities is usually profound. The abandoned steel mills, empty warehouses, and jobless workers of the Rust Belt are essential elements of the picture of the post-industrial landscape.

In New York City alone, 429,200 manufacturing jobs were lost between 1967 and 1987. The same period saw a gain of 302,296 taxable service jobs.7 White-collar services constituted between 20 and 40% of central city economies in 1970, as much as 40 to 60% of the same economies by 1990.8 Saskia Sassen argues that the decentralized development of the 1970s and ’80s has been possible only through the simultaneous consolidation of financial and legal services in select centers.9 These so-called producer services (accounting, marketing, advertising, public relations, banking, insurance, real estate, and law) have largely remained in the deal-making downtowns, where face-to-face handshakes in club-like corporate boardrooms and proximity to courts and government agencies continue to retain value. However, in the more competitive ’90s, stockholders are pressuring CEOs to reduce real estate expenses (typically 25% of the corporate balance sheet) either by leaving prestigious addresses or by reducing office space from about 265 square feet to 200 square feet per employee.10 Indeed, while the CBD highrises of producer services are a significant aspect of the post-industrial landscape, their benefits have actually been limited. The higher educational skills required in producer services, relative to manufacturing, have made many of the urban poor unemployable in these industries.11 And not all cities have attracted producer services. About half of the twenty-five largest metropolitan areas in the U.S. saw their population and employment decline or stagnate between 1970 and 1990, largely due to their inability to move from manufacturing to services.12 Those cities with the most exurban growth have the greatest need of producer services, sponsoring twin booms in the highrise downtowns and the lowrise periphery.

The exurban landscape of sport-utility vehicles, sprawling lowrise office buildings, and big-box retail is the nexus of the post-industrial economy. Over the past quarter century, the industrial economy’s longstanding model—concentrated downtowns surrounded by bedroom suburbs—has been dramatically transformed. Manufacturing, wholesaling, large-scale retail, commercial back-office space, as well as corporate headquarters—all have moved to suburbia and exurbia. A few statistics illustrate the degree of change. 25% of office stock was in suburbia in 1970, 57% in 1993.13 By 1988 over 70% of the commercial office space of Detroit, Dallas, and Atlanta lay outside their CBDs.14 In CBDs employment grew during the 1980s at about 1% annually, in suburbia at about 3.4%.15 Central cities housed about 42% of corporate headquarters in 1984, 29% in the early 1990s.16 Since the 1970s the majority of Americans have lived in the suburbs. Between 1980 and 1990, the rate of suburban population growth was more than twice that of central cities. And between 1977 and 1987, two-thirds of new employment in America’s sixty largest metropolitan areas was in suburbia. Over the same period, the suburbs captured 120% of net job growth in manufacturing, while central cities suffered absolute losses in manufacturing employment.17 By 1989, an estimated three million acres of farmland were being converted to other uses every year.18 In 1992, at least five-and-a-half square miles of rural land were being converted daily to urban or suburban uses.19

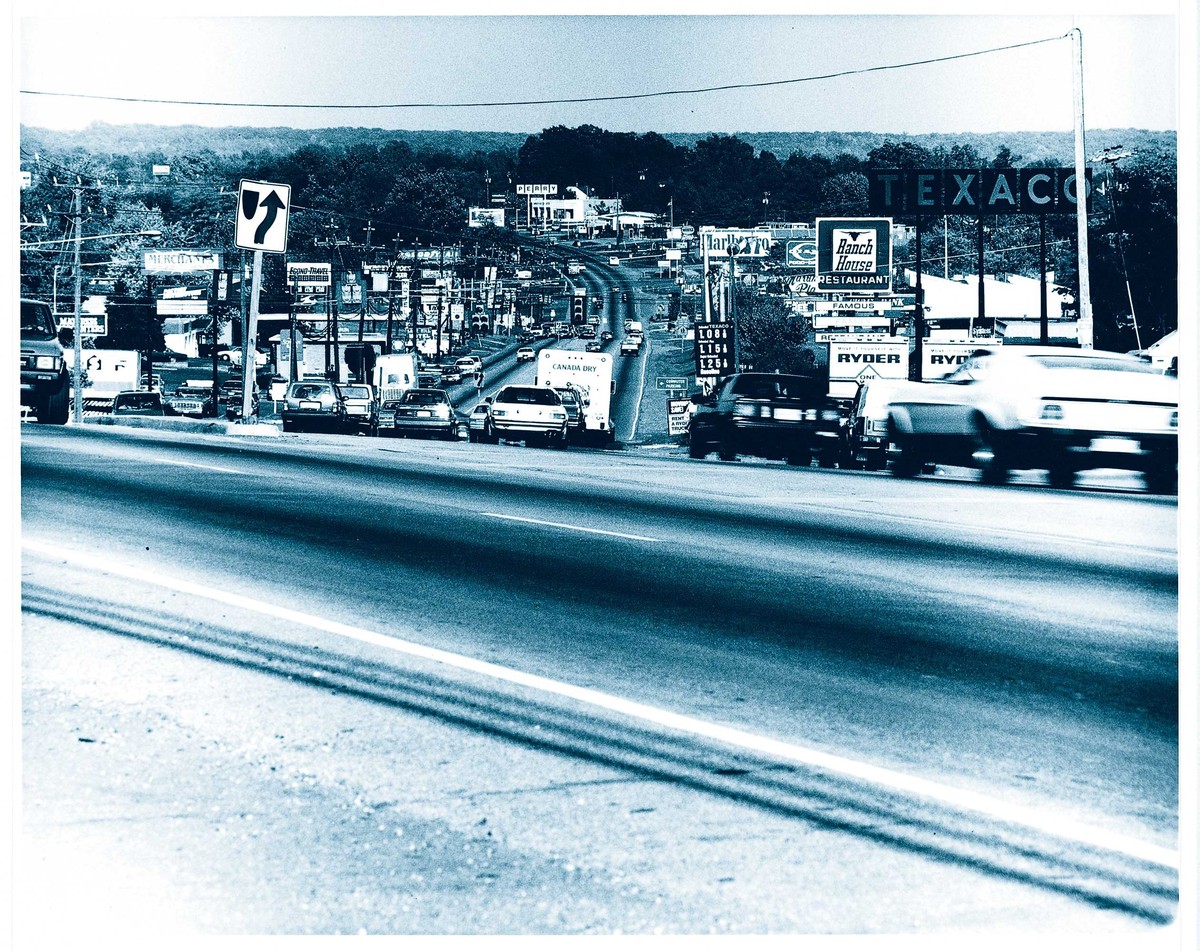

Ubiquitous and yet anonymous, seemingly undesigned, a new landscape of strip malls, office parks, and gated “communities” has erupted, sclerosis-like, along the increasingly clogged multi-lane arteries of the late-20th-century suburban-rural fringe. Variously referred to as beltway boomtowns, exurbs, postsuburban development, or edge cities, these asphalt spreads of isolated office pods and occasional upscale sylvan office campuses, interspersed with commercial franchises and townhouse clusters, are typically located at suburban spoke-and-hub highway intersections next to regional shopping malls.20 And while the suburbs used to zone out non-residential uses, the new “clean” clerical jobs and light manufacturing are now welcomed. The infinite stretch of the electronic umbilical cord has allowed this “satelliting” of work.

The interstate has assisted in these transformations. Designed to allow high-speed traffic to bypass major cities, the interstate also provides easy access to cheap, minimally regulated land, not to mention the relatively docile, non-unionized, educated labor force of suburban housewives and single women. The result of mobile capital and corporate strategies of flexible accumulation, edge cities exemplify the post-industrial landscape. Cities only in scale, they have little sense of community (few churches, bowling leagues, Rotary or Kiwanis Clubs, etc.), few public services, and almost no public space. Made possible by the government-subsidized highway system, most edge cities have no public transit—even sidewalks are hard to find. Edge city is designed to be experienced hermetically, from the car. It is neither concerned with nor apologetic about its future, about the future of an aging population, or about the future of the fossil fuels upon which it so heavily depends.

Beyond the highway exits, the most notable landmarks in edge cities are the regional malls. As cities declined in population in the 1970s, retail moved to booming suburbia. Feverish construction through the ’80s produced nearly 4.6 billion square feet of total store space in the U.S.—about twenty square feet for every person in the country, the addition of a 34,000-square-foot store every hour.21 Population grew 10% in the ’80s, retail floor space 80%.22 However, the 1996 Emerging Trends in Real Estate warns that at least 15% of regional malls in operation in the early ’90s will close within the next five years.23 Already in 1992, an estimated 3,800 abandoned malls littered the landscape.24 In the ever-spectacular ’90s, a twenty-year-old mall is considered obsolete; typically it will either be abandoned or renovated with glitzier materials, “more entertaining” public areas and more anchor stores, or “demalled,” that is, stripped of enclosed passages and common areas and reconfigured as a “power center” for big-box discounters.25 This trend to eliminate malls, along with their short life expectancy, further emphasizes the ephemeral and commodified space of the contemporary market. Rather than serving as communal spaces of interaction for diverse residents, power centers are designed to maximize quick, cheap transactions. Sadly, the mobility that so characterizes the American dream has resulted in a landscape of vacuous temporary contracts.

This low-commitment attitude informs all aspects of the post-industrial landscape. When Crown American recently announced a 43% dividend reduction to fund mall redevelopment, the stock price immediately dropped nearly 30%.34 Investment in renovation and restoration of existing facilities, like investment in research and development, though necessary for long-term viability, reduces short-term profits. To investors, “life cycles are squeezing down; a thirty-year-old building is getting old.”35 The same is true of the housing market. Despite the social and environmental benefits of redeveloping brownfield or infill sites, the costs of renovating inner-city or first suburban ring housing exceed those of building new units on cheap, exurban land. So instead of reinvesting in permanent settlements, we are leapfrogging each exurban ring of development in search of cheaper land farther away from the supposed ills of the city; on this land we make yet another temporary—thirty-year-maximum—investment.

The rate at which the post-industrial economy promotes sprawl is staggering. Christopher Leinberger, a real estate analyst who has watched edge city development closely for the past decade, recently noted that a third tier of development has leapfrogged to even cheaper land (warehouses are now typically forty to seventy miles outside of city centers); its density is semi-rural. As a result, while Chicago’s population grew 4% from 1970 to 1990, its size grew 45%. Los Angeles is an even more extreme case. Its population grew 45% in that time period, while its size grew 300%. Metropolitan Los Angeles is now the size of Connecticut.36 We have discovered that even land, one of life’s seemingly enduring constants, can be consumed.

Temporary contracts—of all kinds—are based on consuming rather than sustaining relationships. The more one’s life, property, and landscape consists of temporary contracts, the more one operates as a lone nomad, a sole proprietor within the overwhelming structure of global capital. The lack of constraining relationships affords tremendous individual freedom—but at a cost. A world of temporary contracts inhibits sustained belonging of any kind, inhibits bonding to either people or place. We substitute consumerism and mass media for communal and intergenerational ties. And we are not victims of the post-industrial economy so much as willing participants in its inflation of our material needs and demands for gratification. But the exchange of long-term relationships for short-term transactions has left us a crowd of perpetual strangers who often fail to recognize the value of shared needs and aspirations. Increasingly estranged from the public realm, from a society’s commitment to preserving its past and protecting its future, we live instead in the private, expedient landscapes of mobile capital, dedicated largely to the present. And such landscapes are probably the least sustainable systems imaginable.

A Nation of Nomads

In the 1960s, Hannah Arendt distinguished between objects of culture and objects of consumption in terms of their capacity to endure or to be used up.37 Cultural artifacts are preserved because of their enduring value, while commodities are ephemeral, traded to be consumed. Drawing on her earlier analysis of the public and private realms of ancient Greece, she equates the public realm with endurance, politics, and culture, and the private realm with consumption, commerce, and necessity.38 Although the two realms are interdependent, their demarcation serves to distinguish enduring political concerns from immediate economic concerns in ways that encourage democratic debate on matters of communal rather than individual interest. Arendt’s critique of the gradual encroachment of commerce into the public realm, in The Human Condition, is just as valid today as when published, in 1958.

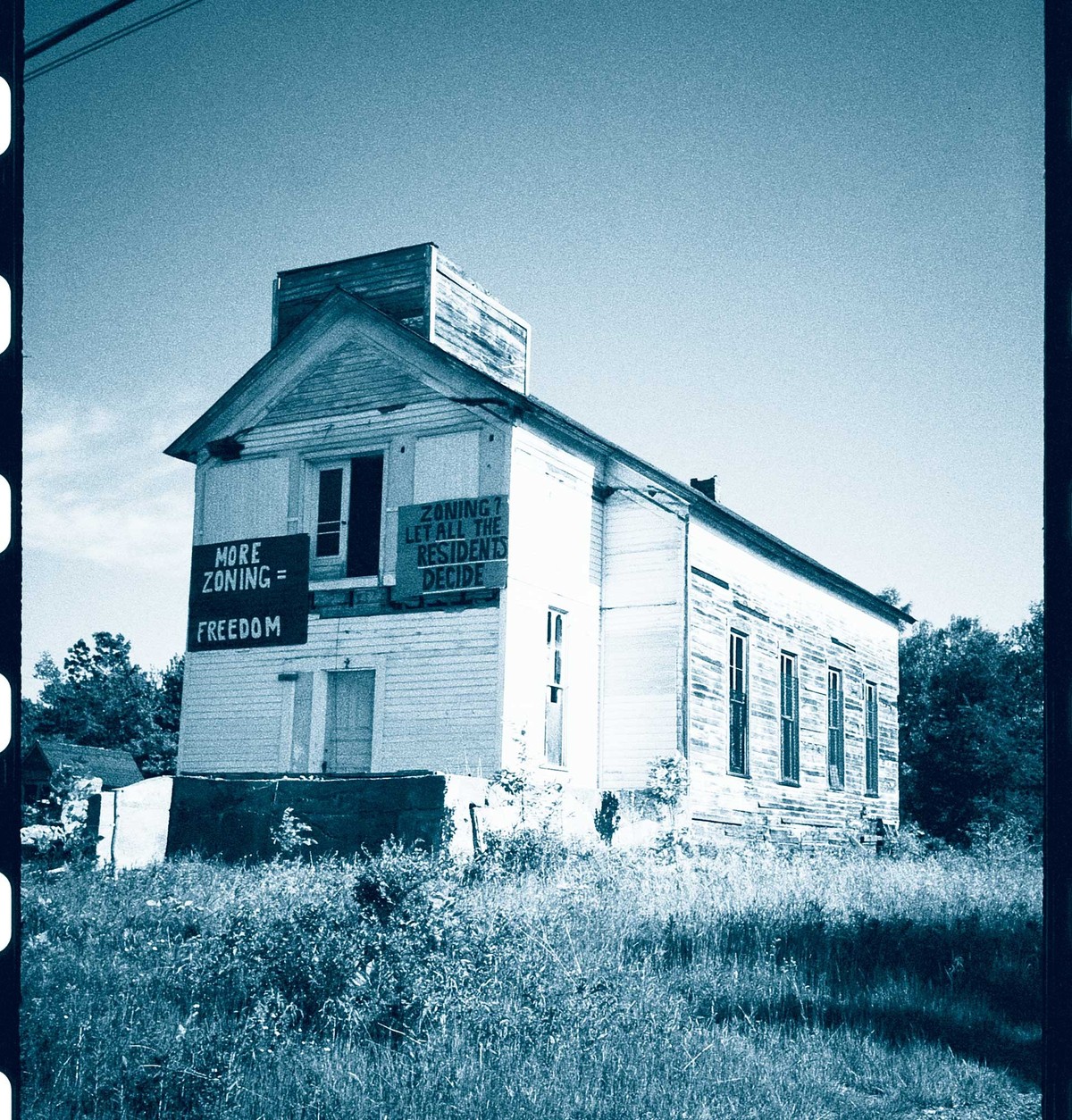

In most cases, of course, the post-industrial landscape of temporary contracts has never had a public realm to be encroached upon or to decline. Essentially a land-assembly package, it has promoted market freedom rather than political responsibility. And much as the public activities of Greek democracy were made possible by the private labor of women and slaves, our post-industrial lifestyles are made possible by the sweatshops of global capitalism. Economically interdependent, the landscapes of exurban sprawl and offshore production facilities are dominated by commerce, intolerant of political debate, and based on temporary relationships.

Arendt would no doubt argue today that, despite efforts to present contemporary design as an enduring contribution to an evolving culture, architecture in the post-industrial landscape has become commodified, designed to be consumed, and therefore is inherently of temporary value. The typical market-driven strip architecture of Butler buildings, Dryvit condos, veneered office buildings, and franchise prototypes serves the cause of client gratification rather than intergenerational responsibility. But even ambitious attempts to create a “critical” architecture—an architecture that resists commodification—have largely failed to resist the dictates of short-term fashion. Commercial and avant garde architecture are now equally consumable. Both aspire to be of-the-moment, one through sophisticated market research into consumer profiles, the other through representation of the zeitgeist, either by incorporating new technology or reflecting cultural criticism. The fifteen minutes of fame accorded to the various “isms” and discourses of recent years raises questions about the commodification of architectural theory as well.

Is contemporaneity inherently consumed? In a post-industrial culture of disposable assets and constant flux, the capacity of architecture to commemorate events, achievements, people, etc., takes on unique value—especially to potential patrons seeking recognition. Rafael Moneo has suggested that the deliberately vulnerable and contingent aspect of Frank Gehry’s architecture will lead to its preservation as an enduring cultural contribution.39 Representative of a particular moment, it can contribute over time to the historical continuity of a place. But while such a strategy often works well for institutions seeking the commemoration of distinct objects, it fails to address the problems of the larger landscape. If the economic commitment to the post-industrial landscape is only temporary, the environmental and social consequences of this new kind of sprawl are not. As we pave paradise and further distance jobs from cities, we reproduce urban poverty in suburbia, exacerbate racial and economic segregation, and force increased dependence on automobiles. We are building neither a sustainable landscape nor a sustainable culture. Yet our profession seems barely to notice this predicament. Our magazines celebrate individual stylistic successes, while our academic journals debate critical theoretical issues that only marginally relate to building. The more we as a profession ignore the dominant, mainstream built landscape, the more we marginalize our work and ourselves both in the economy and in the culture. The landscape of the post-industrial economy surrounds us. It presents us with new challenges. We need to wrestle with the question of how architecture—traditionally conceived of as an enduring cultural artifact—might better respond to the culture of the temporary contract.

Wal-Marting the World

Wal-Mart, the most successful discount department store, is perhaps the most insidious at undercutting the stability of local communities. By locating in (once) underserved rural areas, eliminating distributors, linking inventory directly to computer-controlled manufacturing, and limiting advertising, Wal-Mart cut prices and expanded their market share. In 1995 they owned 2,133 Wal-Marts, 438 Sam’s Clubs, seventy-five deepest-discount Bud’s, and 143 much larger and faster-spreading Supercenters.26 Kenneth E. Stone, a professor of economics at Iowa State University, estimates that “small towns (pop. 500 to 5,000) located near a Wal-Mart store tend to suffer economically. Within five years of a Wal-Mart’s opening, small towns within a twenty-mile radius of the store suffered cumulative net sales reductions of 19.2%. Small towns much further away (but still within driving distance) suffered sales reductions of 10.1%.”27 This severe negative impact on existing stores, many of them Main Street Mom-and-Pops, has earned Wal-Mart a reputation for killing small downtowns.

Wal-Mart’s locational strategy further constricts the noose around local businesses’ necks. Wal-Mart does not simply look for opportunistic singular sites; they target entire regional markets (making it much harder to keep them out). They then simultaneously open stores of 90,000 square feet or larger within forty or fifty miles of one another (they have 230 stores in Texas alone and account for approximately 30% of all retail sales in the state of Arkansas28). They speed merchandise to and through these stores using a practice known as “cross-docking”: goods at the warehouse/distribution center are not stored at all but broken down and immediately reorganized for reshipment to other destinations. The automated equipment needed for such coordination is expensive but it keeps stores well-stocked (further enhancing sales) and pressures retailers to consolidate as they expand.

Typically, Wal-Mart buys the land for new stores as quietly as possible, then sells the land and leases the building when construction is done. In this way Wal-Mart uses the common practice of leasing as a strategy for abandoning a market once it has damaged the local economy and begun to compete mainly with its own neighboring Wal-Marts. Although still profitable, two Wal-Marts in Oklahoma — those in Nowata and Pawhuska — were closed in 1995; the result was what Wal-Mart considers a consolidation: a multi-acre supercenter in Bartlesville, thirty miles from both Nowata and Pawhuska. The impact on Nowata’s tax base was profound: in 1995, the city’s $1.2 million municipal budget was about $80,000 in the red. Often, Wal-Mart will retain the lease on the vacant store simply to keep competition away. In Nowata, they installed a Bud’s, whose merchandise includes a motley assortment of remainders and irregulars. In the words of the former “greeter” at the Nowata Wal-Mart, “Bud’s ain’t got nothing. Wal-Mart had everything.”29 Its Main Street businesses gone, its tax base ruined, Nowata had no choice but to cut city services; the residents had no choice except to drive long distances to big impersonal supercenters for basic goods (almost as if they lived in an edge city). Wal-Mart’s merchandise has not only homogenized consumption patterns throughout the country, it is homogenizing our experience of the landscape.

Wal-Mart’s treatment of its stores and employees as disposable assets, easily sacrificed to consolidations and mergers, exemplifies corporate strategies of flexible accumulation. However, such techniques are not limited to retail operations. Dayton, Ohio’s experience of AT&T’s hostile takeover of National Cash Register and the subsequent re-engineering and layoffs is not that different from Nowata’s.30 Downsizing and corporate relocations are commonplace. Sears sold the Sears Tower in Chicago, eliminated 50,000 jobs, threatened to move to Texas, and finally, once state and local municipalities agreed to supply the land and a dedicated exit from the toll road, relocated its headquarters to a 1.9-million-square-foot campus in Hoffman Estates, an edge city thirty miles south of Chicago. AT&T also sold its Philip Johnson-designed Manhattan building to Sony Corporation and moved to horse country in New Jersey. “Golden Boy,” the Art Deco statue from its original Manhattan location, now stands in a semi-rural field. Similar stories can be told of IBM in San Jose and Bank of America in San Francisco.31

Robert B. Reich, Bill Clinton’s first Secretary of Labor, wrote in 1992, “Speed and agility are so important to the high-value enterprise that it cannot be weighed down with large overhead costs like office buildings, plant, equipment, and payroll. It must be able to switch directions quickly, pursue options when they arise, discover new linkages between problems and solutions wherever they may lie.”32 This cutting of overhead is augmented by the increasing pressure on corporations to respond to stockholders’ demands for profitability rather than reinvestment (in workers, facilities, equipment, and research), especially in the face of recessionary revenues. When Sears announced its elimination of 50,000 jobs, its stock climbed 5%, earning especially handsome dividends for the directors who made the decision. John T. Preston, Director of Technology Development at MIT’s Technology Licensing Office, writes:

Much of the blame for the short-term corporate attitudes in the U.S. may rest with our investment behavior. There have been huge shifts over the last fifty years in the buying and selling of stocks in the U.S. Today the net effect is that stocks are churned at a much higher rate. Money that could go into supplying growth of U.S. industry is being speculated on instruments like ’derivatives’ and ’shorts’ that fail to provide a sense of ownership…. There is a basic difference between the behavior of a company that has ’owners’ and a company that has ’speculators.’ Owners want to build fundamental strengths, while speculators want to make the short-term price go up. Short-term stock prices are driven more by profit than any other factor. Thus axing long-term investment (like research and development) is the best way to drive up short term performance. Unfortunately, such behavior kills the long-term fundamentals of the company. Owners invest to generate wealth, while speculators invest to shift wealth.33

Ellen Dunham-Jones is an assistant professor of architecture at MIT; this essay is part of a forthcoming book, Progressive Practices: Architecture in Post-Industrial Culture.